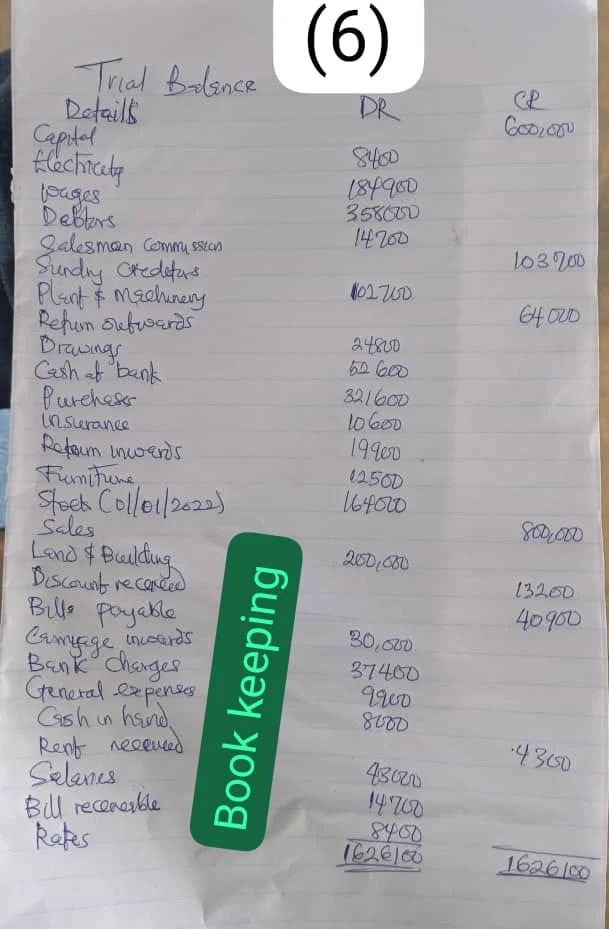

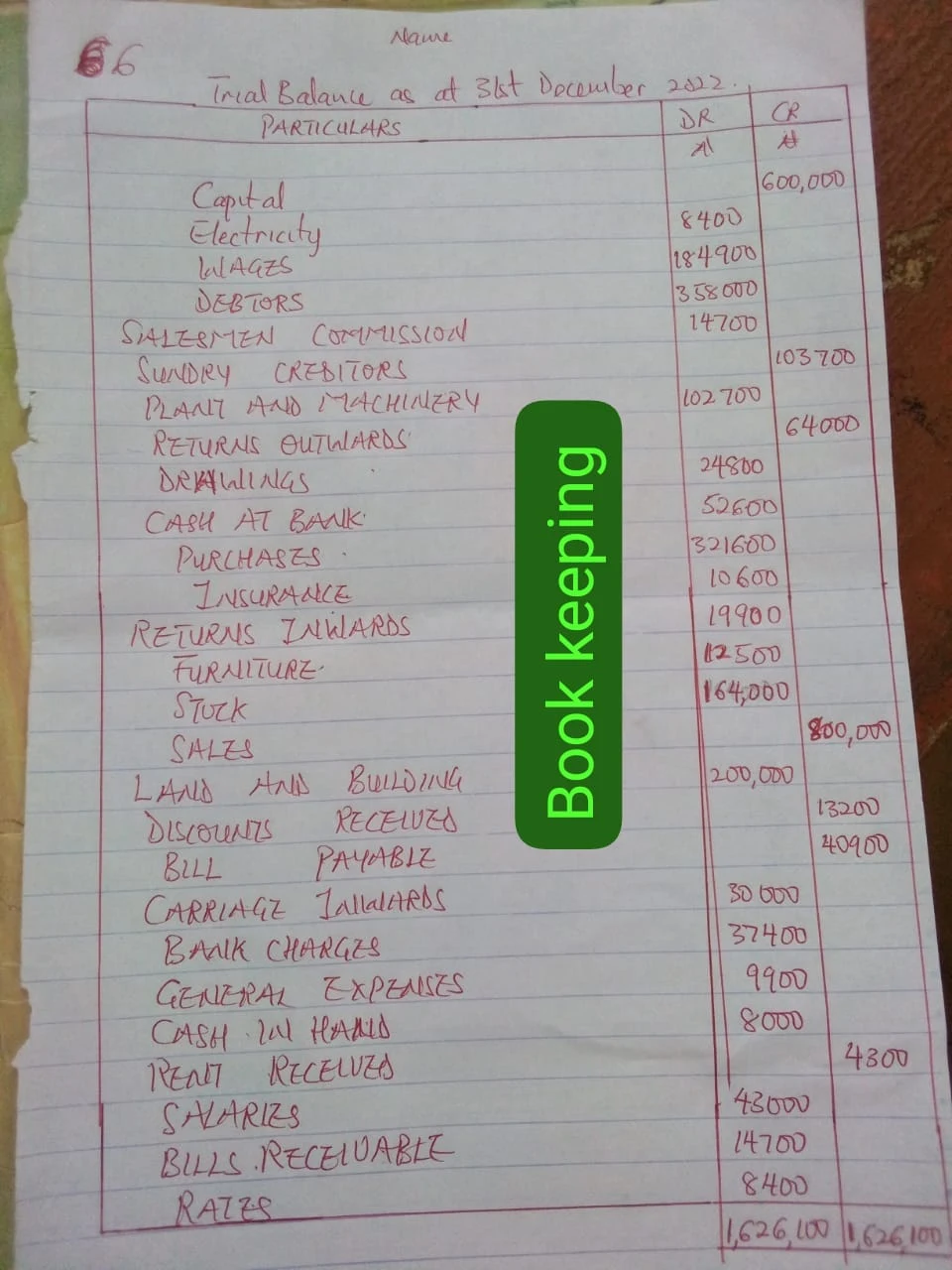

2024 WAEC Bookkeeping (ESSAY) Answers

Question 1

(1a) Limitations of a Trial Balance: (Pick any three)

(i) Doesn’t Detect Errors of Principle: A trial balance may not identify errors related to the classification of transactions. For example, if an expense is mistakenly recorded as an asset, the trial balance will still balance, but the financial statements will be misstated.

(ii) Doesn’t Detect Compensating Errors: Compensating errors occur when two or more errors offset each other, resulting in a trial balance that still balances. For instance, if an amount is over-recorded in one account and under-recorded by the same amount in another account, the trial balance will still show equality.

(iii) Doesn’t Identify Errors of Omission: If a transaction is completely omitted from the accounting records, it will not be reflected in the trial balance, leading to an inaccurate representation of the financial position.

(iv) Doesn’t Detect Errors of Commission: Errors of commission occur when transactions are recorded with incorrect amounts. If an incorrect amount is recorded, but the debits and credits still balance, the trial balance will not detect this error.

(v) Timing Differences: Trial balances are prepared at a specific point in time, usually at the end of an accounting period. Therefore, it may not capture transactions that occur after the cutoff date but belong to the current period, leading to incomplete or inaccurate financial reporting.

(1b) Functions of the Ledger: (Pick any three)

(i) Recording Transactions: It serves as a central repository for recording all financial transactions of a business.

(ii) Tracking Account Balances: Allows businesses to monitor the balances of individual accounts, such as assets, liabilities, revenues, and expenses.

(iii) Preparing Financial Statements: Provides the data needed to prepare accurate financial statements like the balance sheet and income statement.

(iv) Facilitating Analysis: Enables businesses to analyze financial performance, identify trends, and make informed decisions based on financial data.

(v) Ensuring Compliance: Helps ensure compliance with accounting standards and regulations by maintaining a comprehensive record of financial activities.

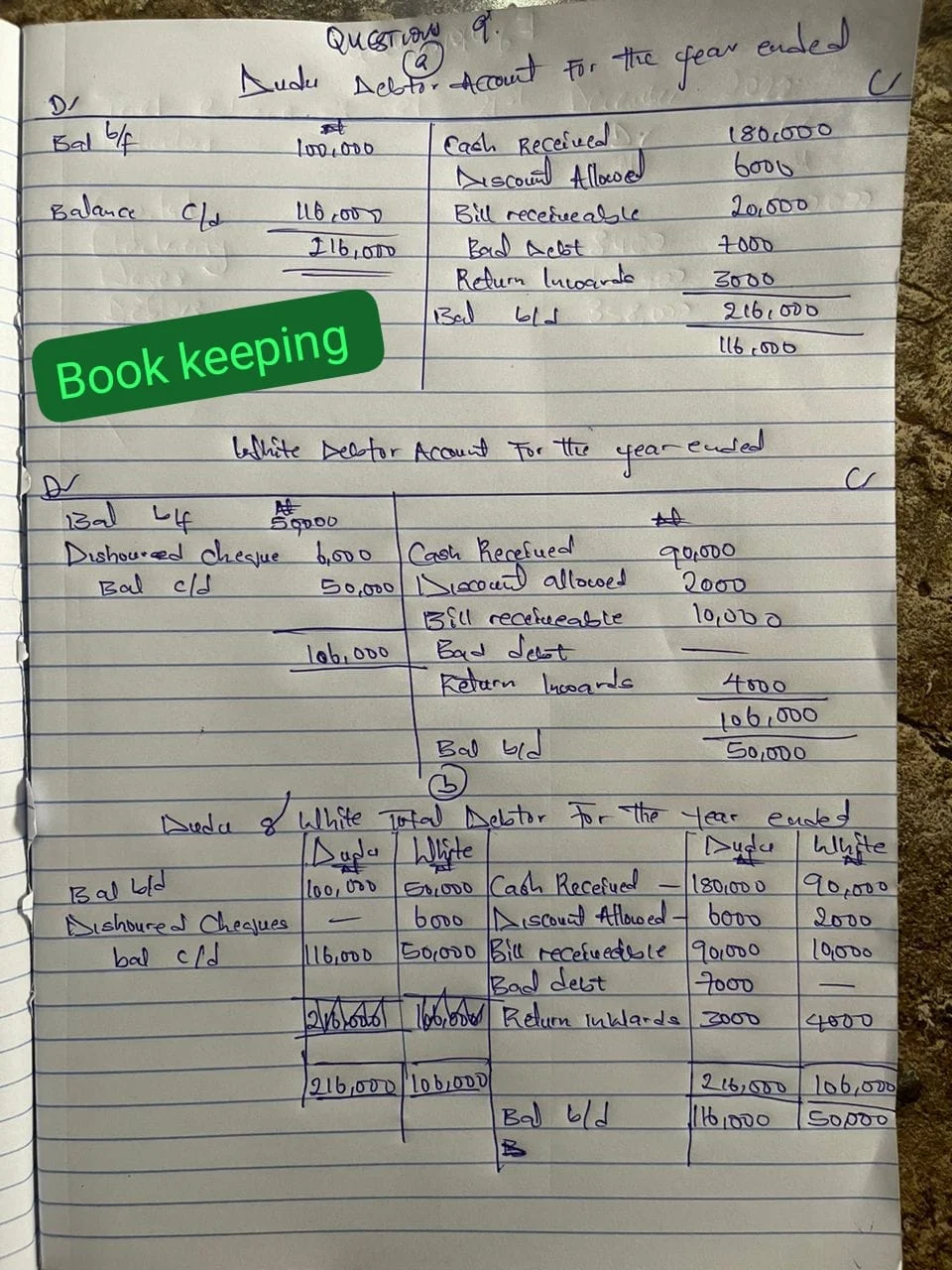

Question 4

(4a) Drawings:

Drawings represent withdrawals made by the owner for personal use from the business’s funds or assets. Drawings decrease the owner’s equity in the business. They are typically shown as a deduction from the owner’s equity section in the balance sheet, reducing the total equity amount.

(4b) Creditors:

Creditors represent entities or individuals to whom the business owes money for goods or services purchased on credit. They are categorized as liabilities on the balance sheet, specifically under the current liabilities section. The amount owed to creditors is reported as the total outstanding balance owed by the business at the reporting date.

(4c) Debtors:

Debtors, also known as accounts receivable, represent amounts owed to the business by customers or clients for goods sold or services rendered on credit. Debtors are categorized as assets on the balance sheet, specifically under the current assets section. The amount owed by debtors represents the total receivables that the business expects to collect in the near future.

(4d) Accruals:

Accruals represent expenses that have been incurred but have not yet been paid or recorded in the accounting records. Accruals are categorized as liabilities on the balance sheet, typically under the current liabilities section. These are amounts that the business owes but has not yet paid by the end of the reporting period, such as accrued wages or accrued utilities expenses.

(4e) Stock:

Stock, also referred to as inventory, represents the goods held by the business for sale in the ordinary course of operations. Stock is categorized as an asset on the balance sheet, specifically under the current assets section. The value of stock is reported at the lower of cost or net realizable value, reflecting the amount the business expects to realize from selling the inventory.

CLICK HERE TO JOIN TELEGRAM CHANNEL