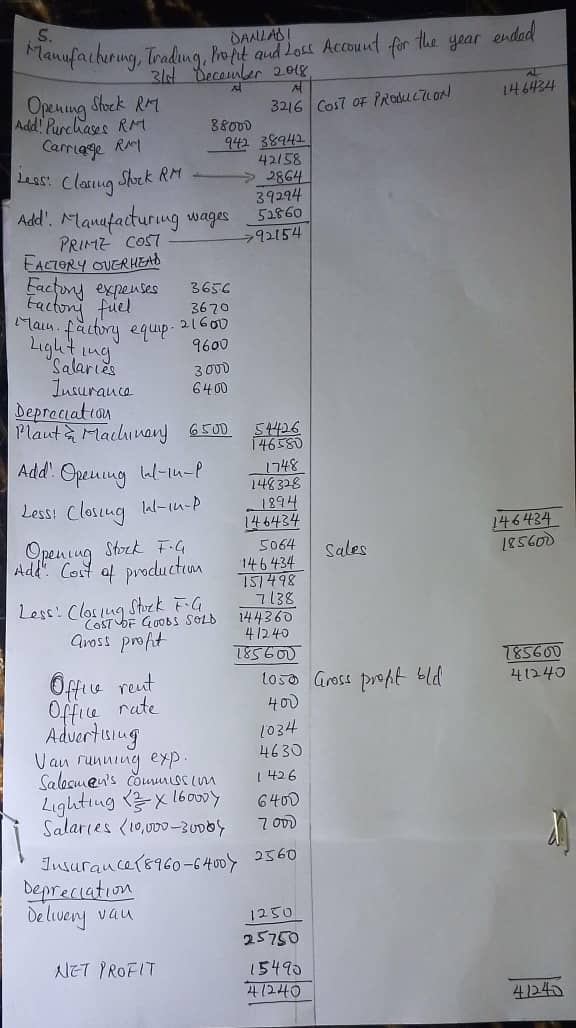

2025 NECO Financial Accounting OBJ & Essay Questions and Answers Free of Charge | NECO June/July Free Financial Accounting (Objectives and Theory) Questions and Answers EXPO Room.

Neco June/July 2025 Financial Accounting Obj/Essay Questions And Answers

This is to inform all students preparing for the 2025 NECO SSCE exams and the school administrators that the June/July NECO FINANCIAL ACCOUNTING Expo/Runs ESSAY//OBJ Questions and Answers for 2025 are now available. The exam will commence on Tuesday, 9th July 2025

Neco Financial Accounting (Objective & Theory) Questions And Answers 2025

CLICK HERE TO GET FULL QUESTIONS AND ANSWERS

NECO 2025/2026 FINANCIAL ACCOUNTING Expo/Runs OBJ & ESSAY QUESTIONS

Financial Accounting (Objective & Essay)

NECO 2025 Update

Remember

You can still subscribe for NECO.Important

The price will go up next week!Subscribe Now

Pay now and get:

Added to NECO VIP Group

Answers sent to you from midnight

Subscribe now, don’t delay!

👇👇👇

NOTE: NECO June/July 2025 Free Financial Accounting objective and Theory/Essay Question and Answer Room: Prepare effectively and ensure your success in the exam with our comprehensive resources.

=====================================

2025 NECO Financial Accounting Obj Questions & Answers

FINANCIAL ACCOUNTING OBJ

01-10:

11-20:

21-30: ……..

31-40: ……..

41-50: …….

51-60:

Solving/Typing…

=====================================

2025 NECO Financial Accounting Essay & Theory Answers

=====================================

Loading…….